Why RA 10068 is a Must-Know for the Agriculturists Licensure Exam (ALE)

For aspiring agriculturists, the shift toward sustainable and environmentally conscious farming isn’t just a trend—it’s law. The Republic Act No. 10068, or the Organic Agriculture Act of 2010 (as strengthened by RA 11511 in 2020), is a foundational policy that sets the Philippines’ path toward eco-friendly food production.

Mastering this law is essential for the ALE, as it touches upon Crop Science, Soil Science, Agricultural Economics, and Extension.

🎯 Key Policy Goals: The “Why” Behind the Law

The primary objective of RA 10068 is to promote, propagate, and develop the practice of organic agriculture throughout the country. You should know these four core goals for the exam:

- Soil Enrichment: To cumulatively condition and enrich the fertility of the soil over time, primarily through natural inputs like compost and organic fertilizers.

- Environmental Protection: To reduce pollution, minimize chemical run-off, and preserve biodiversity.

- Increased Productivity & Income: To help farmers achieve higher profitability by reducing costs on imported synthetic fertilizers and pesticides.

- Self-Reliance: To reduce the country’s dependence on imported farm inputs by utilizing and promoting local, organic alternatives.

🏛️ The Institutional Pillars: Who’s in Charge?

The law established two major bodies that implement and regulate the program. Knowing their roles is key to answering organizational questions on the ALE.

1. The National Organic Agriculture Program (NOAP)

This is the comprehensive program housed under the Department of Agriculture (DA). The NOAP is responsible for the actual delivery of services, which includes research and development, farmer training (capacity building), and consumer education.

2. The National Organic Agriculture Board (NOAB)

The NOAB is the highest policy-making body. Headed by the DA Secretary, its crucial composition includes representatives from small farmers, NGOs, and academic institutions. This ensures that the policies are practical, transparent, and representative of the stakeholders.

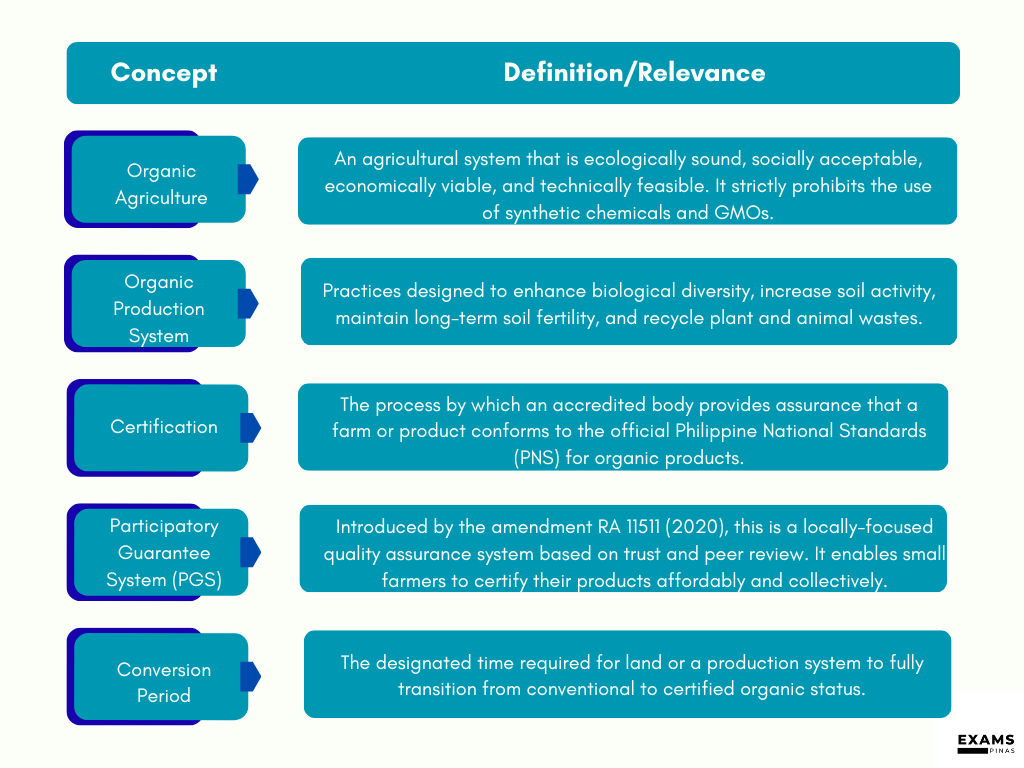

🌾 Core Regulatory Concepts You Must Master

These operational terms define the system and are highly likely to appear in the exam’s technical questions:

What are the Incentives (And Penalties)?

The government provides significant financial motivation to encourage the shift to organic farming, which is an important point for the Agricultural Economics and Agribusiness section of the exam.

Incentives:

- Tax Exemptions: Zero-rated Value-Added Tax (VAT) on the sale or purchase of certified organic produce and inputs.

- Income Tax Holiday: Producers of organic food and inputs may be eligible for an exemption from income tax for up to seven (7) years.

- Preferential Loan Rates from government financial institutions.

Penalties:

The law is clear: mislabeling or falsely claiming a product is “organic” is illegal. Violators face imprisonment and/or a fine up to $\text{Php } 50,000$. This protects the integrity of the true organic market.

Final ALE Tip:

When studying RA 10068, focus on its integration. Think about: “How does the NOAB’s policy (A) translate into an Extension Worker’s demonstration (B), and how does that affect soil fertility (C)?” This integrated thinking will help you ace the exam!